Courtesy of Comptroller Stringer’s Office

By Forum Staff

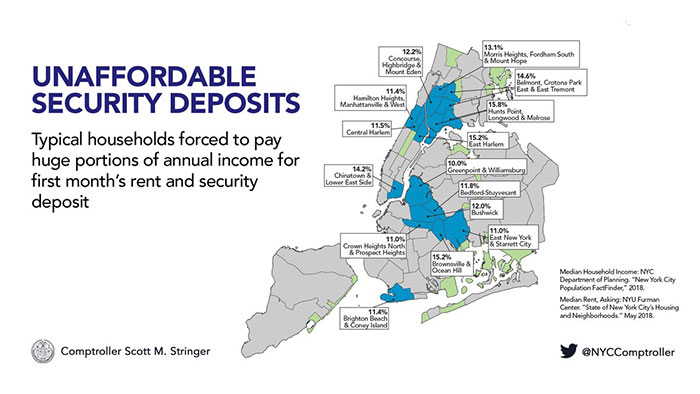

New York City renters sunk approximately $507 million into security deposits in 2016—erecting unnecessary financial barriers and intensifying the city’s affordability crisis, according to a report released on Sunday by City Comptroller Scott Stringer.

As a result of “Insecurity Deposits: A Plan to Reduce High Entry Costs for NYC Tenants,” Stringer is recommending that the State immediately introduce legislation to cap security deposits—which he said can prevent struggling New Yorkers from moving to a more desirable apartment and neighborhood or force them to dig into their savings—at one month’s rent for one-year leases; and calling on the City to explore new models to drastically reduce upfront costs for tenants but still protect property owners against legitimate wear-and-tear and rental arrears.

“To tackle our mounting affordability crisis, we need to think outside the box and put bold ideas into action,” Stringer said. “Our proposals will change the rules of the housing market and put money back in the pockets of thousands of families looking for a bigger apartment in a better school district, to new graduates who have to find a place to live while paying down their student loans. For too long, the deck has been stacked against New York’s working-class renters but we’re taking a step forward to reimagine how the housing system works in our city.”

The comptroller’s proposals:

One-Month Cap: Place a cap on security deposits at one month’s rent on a one-year lease. Rent-regulated units are already protected by a one-month limit on security deposits; this proposal would expand the protection to all units within the city.

Reducing Upfront Costs and Expanding Tenant Choices: An upfront deposit is not the only way this can be achieved. Different strategies include:

• Installment plans: Tenants should have the option to pay security deposits in installments rather than covering the full burden all at once.

• Insurance as an alternative to the security deposit: A number of local companies have introduced an insurance alternative in recent years. These start-ups allow renters to pay a small monthly or one-time fee in exchange for guaranteeing their security deposit with landlords. While tenants will not receive this money back – as they would with a traditional deposit – paying $10 per month to insure your apartment against damages rather than an $1,800 security deposit is a significant reduction in the upfront costs of moving and can be a desirable trade-off.

Getting back the security deposit: To combat bad actors and ensure fairer outcomes, the City can create a tenant protection system where security deposits are held by a third-party custodian and arbiter rather than the landlord.

If the landlord wishes to withhold money for damages, cleaning fees, or unpaid rent at the end of a lease, they must come to an agreement with the tenant. In instances where there is a dispute over damages or the cost of repairs, the landlord and tenant can utilize the dispute resolution service run by the third-party organizations that hold deposits. These services cost nothing but require both parties to agree to be bound by the decision, Stringer noted.

Courtesy of Comptroller Stringer’s Office