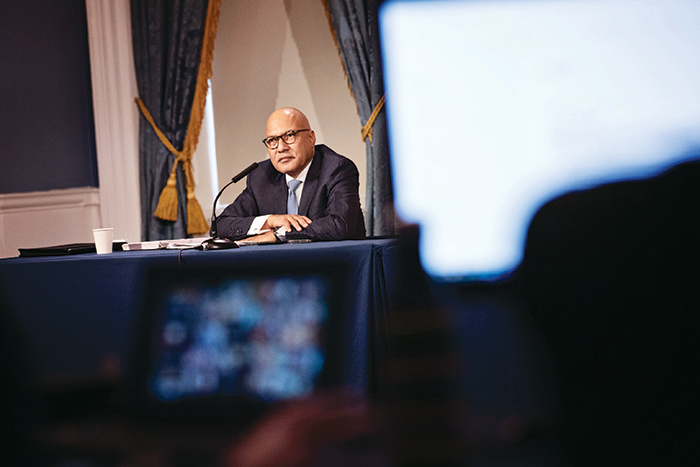

Photo Courtesy of Michael Appleton/Mayoral Photography Office

“It has been nearly 20 years since the City and State of New York increased the Earned Income Tax Credit benefit that has helped so many low- to moderate-income families,” Mayor Adams said.

By Forum Staff

Mayor Eric Adams recently provided testimony to both the State Senate Finance and Assembly Ways and Means committees, focusing on several key initiatives aimed at making the five boroughs safer and more prosperous: Substantial investments in an enhanced Earned Income Tax Credit, a new childcare tax credit, and investments in mental health resources.

Key components of Mayor Adams’ testimony include:

On mental health resources

“It is urgent that we request the state’s immediate assistance in expanding the number of beds for those in critical need of mental health care, and funding for the medical and support staff they require.

Too many of our fellow New Yorkers are cycled through temporary care and released before they are ready, often due to the limited availability of long-term support and housing.”

On Earned Income Tax Credit

“The second major step of my plan is to increase the Earned Income Tax Credit. It has been nearly 20 years since the City and State of New York increased the Earned Income Tax Credit benefit that has helped so many low- to moderate-income families.

“That is why I’m asking the state to authorize the city to boost the amount the city gives back to recipients of the Earned Income Tax Credit, up to 30 percent of the federal benefit depending on income.”

“In addition, I am calling on the State to match our efforts by increasing the amount it gives back to recipients with an additional state investment of up to $250 million.”

On childcare tax incentives

“Two additional proposals could help create more childcare space by utilizing tax incentives.

The first proposal would authorize the city to offer property owners a tax abatement for retrofitting space to establish childcare centers.

“The second proposal would authorize New York City to provide a tax credit to companies that provide free or subsidized childcare for their employees in their place of business.”