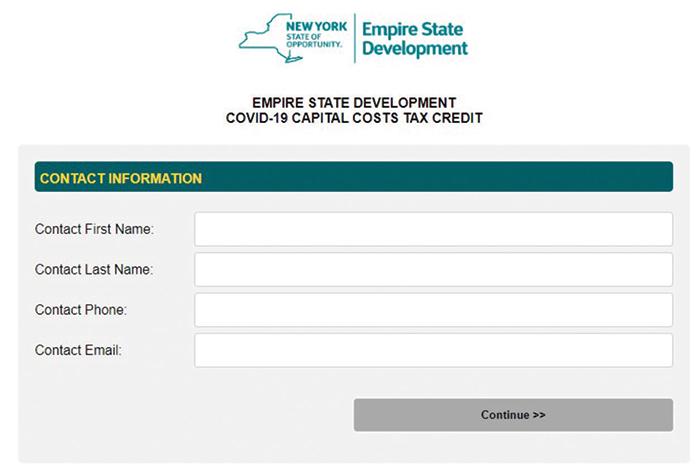

Courtesy of Empire State Development

The screening tool is located at formrouter.apps.esd.ny.gov/ccs@ESD/covid_cost_screening.html

By Forum Staff

Governor Kathy Hochul on Tuesday announced the opening of the initial intake tool to help small businesses determine their eligibility for the COVID-19 Capital Costs Tax Credit Program. The $250 million COVID-19 Capital Costs Tax Credit Program will support small businesses that made investments to comply with emergency orders and regulations or to increase public safety in response to COVID-19. If deemed eligible by the screening tool, a link to the application will be provided when the program application opens.

Small businesses were hit particularly hard by the pandemic downturn. Announced as part of Hochul’s Executive Budget to continue the State’s support for small businesses, this new refundable tax relief program targets COVID-19-related expenses. Eligible COVID-19-related costs include, but are not limited to:

- Supplies to disinfect or protect against COVID-19 transmission

- Costs associated with expanding, or defining space to accommodate social distancing

- HVAC equipment

- Expenses related to increased outdoor activity and outdoor space expansions

- Machinery and equipment to facilitate contactless sales

Tax credits will cover 50 percent of eligible costs, up to $50,000, for a maximum tax credit award of $25,000, and credits will be awarded on a first come first serve basis until program funds are depleted. Eligible businesses must operate a location in New York State, have 100 or fewer employees, $2.5 million or less of gross receipts in the 2021 tax year, and at least $2,000 in eligible costs between Jan. 1, 2021 and Dec. 31, 2022.

Businesses are still encouraged to apply for the New York State COVID-19 Pandemic Small Business Recovery Grant Program which provides flexible grants of $5,000 to $50,000 for small businesses for COVID-19 expenses. However costs incurred between Jan. 1, 2021 and April 1, 2021 that were paid for with proceeds from this grant program are not eligible for a tax credit under the COVID-19 Capital Costs Tax Credit Program.

To receive a tax credit for their 2022 tax return, businesses must receive a tax credit certificate from ESD on or before Dec. 31, 2022. Potential applicants are urged to complete the screening tool and apply as soon as the program is launched, as any tax credits issued on or after Jan. 1, 2023 cannot be claimed until a business’s 2023 tax return.

“The pandemic has hit New York’s small businesses especially hard, forcing many to close and others to incur significant financial burdens to protect their employees and customers from COVID-19,” Hochul said. “Small Businesses are the backbone of our state’s economy, and in order to truly recover from the COVID-19 crisis, we must lend a helping hand. This tax credit will be a crucial lifeline to New York businesses and I encourage all who are interested to apply for this much-needed aid.”

Empire State Development President, CEO and Commissioner Hope Knight added, “Businesses have been burdened with many expenses during the pandemic that were necessary to keep their employees and customers safe. This tax credit will ease the burden that the business community incurred during COVID and help it continue to get steadily back on its feet. I am grateful for Gov. Hochul’s support and also for all of New York’s business owners who are working every day to rebuild our economy.”