By Michael V. Cusenza

Millions of Inflation Refund Checks are in the mail, and elected officials are urging eligible recipients to remain vigilant regarding targeted scams.

According to Assemblywoman Stacey Pheffer Amato (D-Howard Beach), the rollout of the checks started in September and will continue till late November, with over 8 million New Yorkers expected to receive a check. The check amounts will be based on 2023 tax filings:

- single earners earning less than $75,000 will receive a one-time check of $200

- single earners making between $75,000-$150,000 will receive a one-time check of $150

- joint filers earning less than $150,000 will receive a one-time check of $400

- joint filers earning between $150,000-$300,000 will receive a one-time check of $300

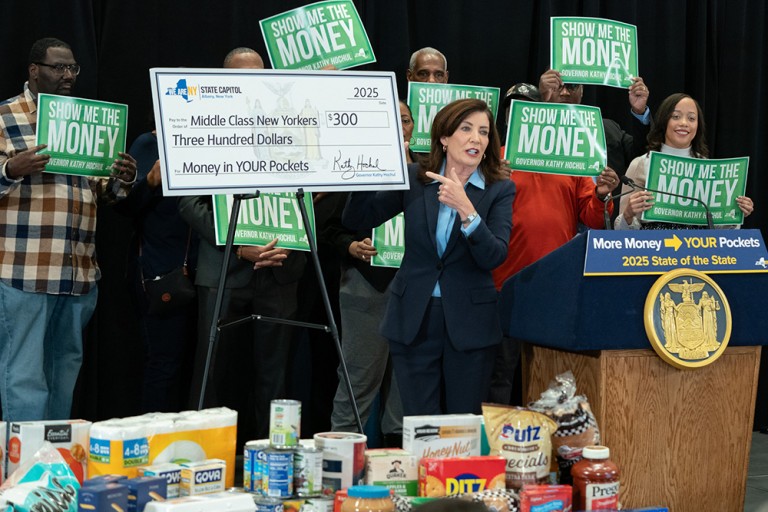

Governor Kathy Hochul has warned New Yorkers of scammers who are sending text messages, voice messages, emails and direct mail to taxpayers in an attempt to spread false information about the State’s inflation refund checks. These messages falsely claim that New Yorkers must submit accurate payment information in order to receive an inflation refund check, supposedly so revenue agencies can deposit money into a taxpayer’s bank account.

The State Tax Department and the Internal Revenue Service will not call or text New Yorkers with requests for any personal information, Hochul noted.

If you receive one of these messages appearing to be from the Tax Department, block the sender, delete the message, and report this scam to the Tax Department or IRS. The Tax Department does not use text messages, email, direct mail or social media to request your personal tax information.

By staying alert and knowing what to watch out for, you can reduce your risk of becoming a target of common tax scams.

Follow these best practices to help keep your personal information safe and prevent yourself from becoming a victim:

- If you receive a threatening phone call regarding your taxes, hang up immediately.

- Never agree to meet anyone who claims to be a tax representative in person to hand over payment for a debt.

- Don’t provide personal information in an email or click suspicious links in an email asking for personal information.

“New Yorkers do not have to do anything to receive an inflation refund check outside of meeting the eligibility requirements,” Hochul said. “With scams targeting the state’s inflation refund initiative, let me be clear: The Tax Department and the IRS do not call or text individuals for personal information. My administration urges New Yorkers to remain vigilant and report these scams to the Tax Department to protect yourself from being a victim.”

If you’ve been scammed or think you’ve received an email, phone call, or text that seems suspicious, report it. The State pledged to review all complaints promptly and, if appropriate, take corrective action.

For more taxpayer scam information, visit the Division of Consumer Protection’s Taxpayer Scam webpage. For additional identity theft prevention and mitigation resources, call the Consumer Helpline at 800-697-1220 or visit the Division’s Identity Theft Prevention and Mitigation Program webpage.