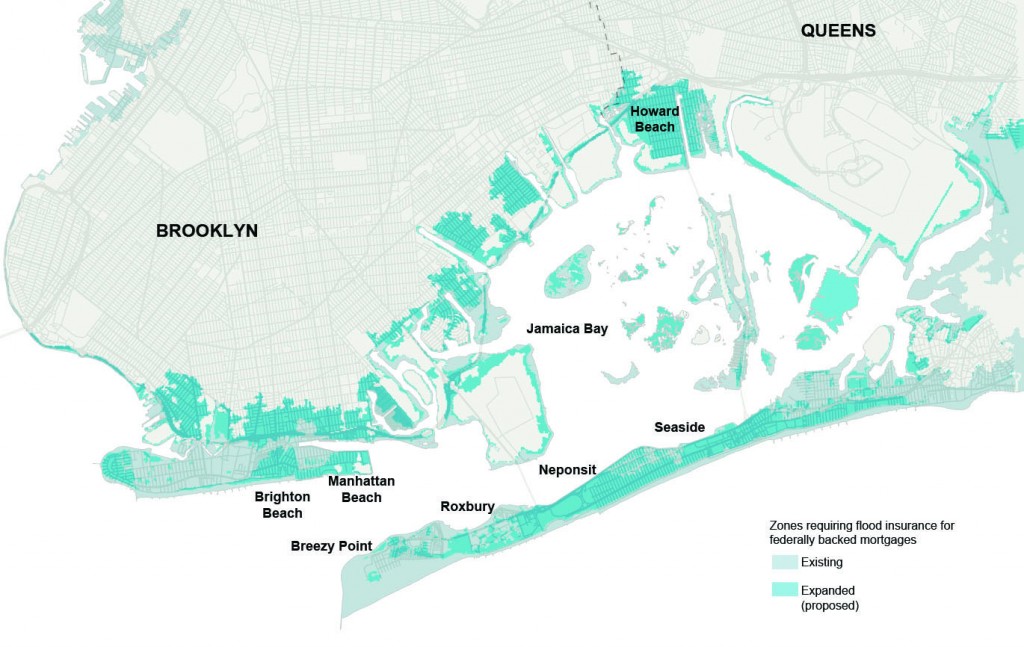

Revised flood maps released on Monday show that as many as 35,000 homes and businesses in the New York City metropolitan area will now be situated in flood zones, compelling more city property-owners to buy flood insurance.

Although the new Federal Emergency Management Agency maps are preliminary and likely won’t be adopted until 2015, they will be used to establish changes in both city building codes and insurance rates and regulations for years to come.

Among the numerous implications of the redrawn maps for residents of south Queens include homeowners who were previously not included in flood zones and thus did not ever budget for flood insurance premiums. The city’s old flood maps were last updated in the 1980s.

Dan Mundy, president of the Broad Channel Civic Association, said he was inundated with phone calls on Monday by concerned local residents who were unsure of what the new maps will mean. “For myself, my first reaction to the new flood maps was one of concern.”

Mundy said that many homeowners will now be faced with the decision to rebuild at a higher elevation, raise their home above the new flood elevations or do nothing and risk significantly higher flood insurance costs.

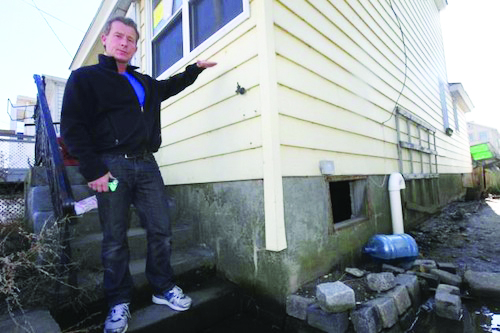

Dan Mundy Jr. stands outside a home typical of those now further impacted by a potential wave of highly escalated rates in flood insurance associated with the newly released revisions of FEMA flood zones.

Most federally-backed mortgages require homeowners to carry flood insurance.

So, some homeowners who were previously located in non-flood zones may now find themselves in a flood zone and thereby required to carry flood insurance, adding in some cases an extra monthly bill that could approach $1,000 according to Mundy.

“The problem I have,” said Mundy, “is when you tell people of modest means, who likely have very tight budgets that they may have to pay close to $9,000 for flood insurance, I don’t know if those people will be able to keep those homes.”

He added, “I see huge implications from these new maps and many people will be stuck paying a lot more money.”

Mundy has also advocated for people in vulnerable flood areas, such as Broad Channel, to undergo the house raising procedure as a way to help prevent future water damage by actually raising a house above the previous flood level.

He advised that a provision in most people’s flood insurance policies, known as the Increased Cost of Compliance or ICC, can help homeowners to defray the cost of house-raising by providing up to $30K for the job.

Mundy estimated that a typical house-raising job in Broad Channel could cost anywhere from $40,000 to $70,000.

Longtime Broad Channel resident Philomena DeVito had her home raised for the third time about five years ago. “Our main

living area didn’t get any water but our heating system in the garage was destroyed in

Sandy,” said DeVito, who noted that in all they

had about five feet of water inside the house.

DeVito, who owns her home outright with her husband Donato, did not have flood insurance. She recalled that flood insurance might have run her close to $1,000 per month.

“I would definitely recommend doing the house-raising as it prevented us from getting water into the main part of the house,” she said. But, nevertheless, she said they were still in the process of cleaning up from the storm.

Jeffrey Geary, an architect based on Staten Island who has done his share of house-raising jobs in Broad Channel and the Rockaways, said that the new flood maps have made some drastic changes.

“We need a response from the city’s Department of Buildings soon on the new designations,” he said, noting that many homes went from minor to major flood zones. “The changes are a big deal and exactly what they mean is up to DOB. Things are very uncertain at the moment.”

Mundy added that some other problems local homeowners could face include older homes that might not withstand being lifted. “You need to make sure that whatever contractor you use has insurance, just in case anything goes wrong,” he said.

Homeowners can find information on the national flood insurance program at www.floodsmart.gov or to find out if a house is located in a flood zone, visit www.region2coastal.com. Additional information on the revised flood maps is available on Facebook at www.facebook.com/home./BroadChannelDisasterReliefForum

By Alan Krawitz