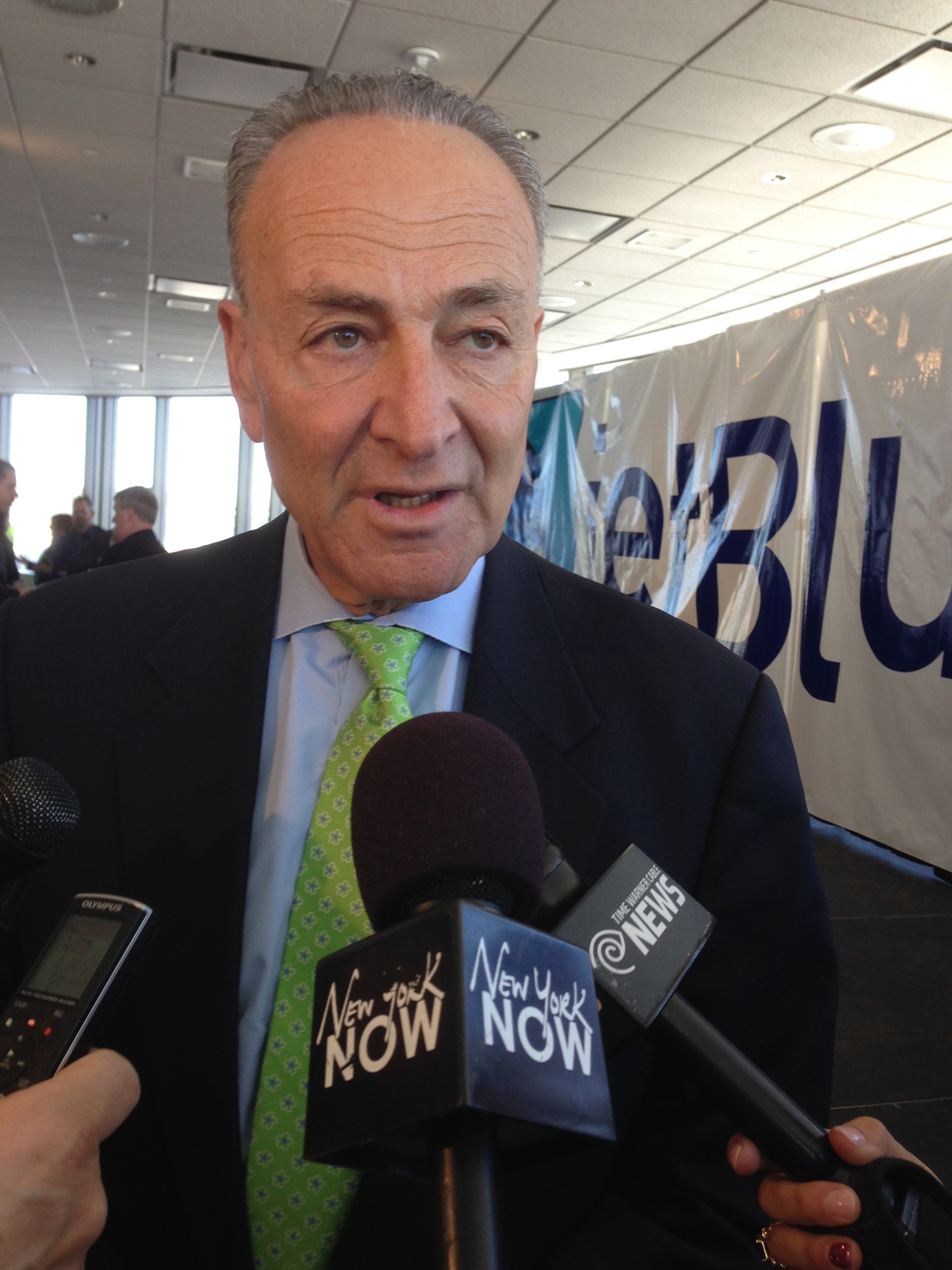

U.S. Sen. Charles Schumer last week sent a letter to FEMA asking them to do away with the old ‘write-your-own’ insurance model. Photo Courtesy of flickr/mmr dad.

The Federal Emergency Management Agency needs to scrap the Write-Your-Own insurance model from the National Flood Insurance Program and move forward to overhaul the “terribly flawed” process entirely, said U.S. Sen. Charles Schumer (D-N.Y.) last week in a letter to the agency.

The WYO model, which has been in place since 1983, allows participating insurance companies to write and service policies in their own names. There are currently over 80 different companies that sell policies.

“Not surprisingly, we have seen the failures of this WYO system manifest through the experiences of homeowners across New York that were victims of Superstorm Sandy,” said Schumer in his letter to FEMA Administrator Craig Fugate. “That’s why I believe that now is the time to eliminate WYOs from the NFIP program entirely.”

While Schumer noted that the WYOs are subject to NFIP’s regulatory practices, he explained that often times the companies are servicing flood insurance claims with the same profit-driven mentality as they would have for their other lines of business.

“The profit-driven motivations and incentives for these companies and their subcontractors to minimize payments to customers and keep costs low are understandable, but not commensurate with a federal flood insurance program that should be designed to provide appropriate insurance protection and make fair payments to those that suffer losses,” Schumer said. “Further, this WYO system also fosters the perverse incentive for the WYOs to fight homeowners in court—because they are not responsible for the legal expenses—rather than arrive at a fair resolution of a claim with a homeowner.”

Later in the letter, Schumer details how retiring WYO is “necessary” and would be “beneficial” to property owners.

The elimination of the WYOs would lead to a system in which policyholders interact with a flood insurance provider that is directly accountable and is in a position to ensure greater consistency throughout the program – from the policies that are offered to the process for evaluating a claim,” he said. “True competition does not exist in the current WYO model anyway, as these providers know that the federal government is ultimately paying for losses they must pay out. Thus, the consistency in how claims are handled and the terms that homeowners pay for could easily mitigate the loss of slightly more varied options offered by private insurers while benefiting the NFIP with an ability to collect and maintain data over how these policies are managed, assessing the risk associated with them.”

Schumer also noted that Fugate doesn’t need “to wait for Congressional action” to make the changes to the flood insurance program.