By Michael V. Cusenza

City Councilwoman Joann Ariola (R-Ozone Park) on Tuesday penned a crucial social media post aimed at area non-profits.

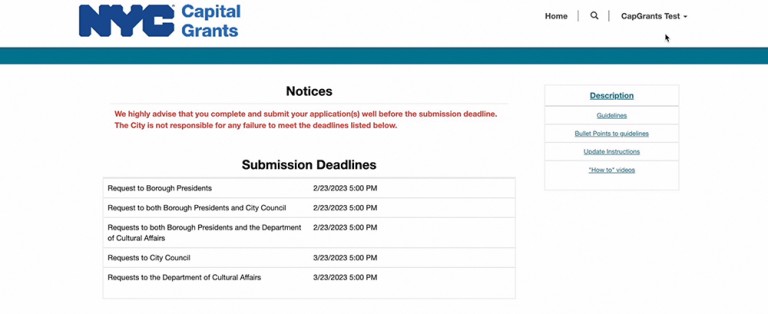

“The application period to file for [Fiscal Year] ‘25 Capital discretionary funding opens on JANUARY 5th! Click this link to find the application page and more info: nyc.gov/site/capitalgrants/index.page,” she wrote. “Deadline is March 21, but DON’T DELAY. If you want to apply for funding, be sure to get your application in as soon as possible.”

Here are some guidelines for FY25 Capital funding requests:

- A Capital Funding Request Form for not-for-profit organizations must be submitted for projects that are (i) on property that is not owned or leased by the City or (ii) owned by the City but are leased to the not-for-profit seeking to enter into a funding agreement or any other contract with the City to receive funds to improve the property (in which case, approval from the City agency that acts as landlord is required and all improvements must comply with the terms of the City lease).

- The recipient organization must be a not-for-profit registered to do business in New York State with a demonstrated history of operating services and programs that are consistent with the Project’s defined City Purpose.

- Once a Project has received an appropriation, the recipient organization may not change the Project to a different location or type of work without submission of a new Form during the application process for the following fiscal year and a re-appropriation of funds for the new purpose.

- The recipient organization must have one or more City operating contracts. For construction Projects, the contracts must be for at least three consecutive fiscal years including the current fiscal year (2024), and have a minimum aggregate annual dollar amount of $50,000. (This requirement does not apply to Cultural Projects.)

- For Moveable Property Projects, the recipient must have one or more City operating contracts in the City fiscal year 2024 with a minimum aggregate annual dollar amount of $25,000. (This requirement does not apply to Cultural Projects or equipment purchases for hospital/clinics.)

- Projects must be for a capital asset under GAAP and City rules.

- No funding may be made available for a Project expected to be used by the recipient for less than five years, except that funding may be made available for a Project consisting of computer hardware, software, networks, and information technology systems expected to be used by the recipient for three or more years.

- The recipient organization must agree to a lien (restrictive covenant or security agreement) in a senior position on the property for its entire useful life.

- Projects involving land or buildings must have a minimum City contribution of at least $500,000.

- For Moveable Property Projects, each item or equipment system must cost at least $50,000, unless it is for Initial Outfitting of new space.

- For Projects involving Moveable Property that has a minor degree of attachment to real property, the Project must have a minimum City contribution of at least $250,000.

- The City contribution may not exceed 90% of the capitally eligible portion of a real property Project up to $2 million and 50% of the portion in excess thereof. Furthermore, the City may pay a maximum of 50% of real property Project costs once City appropriations at the same address for the same exceed $2 million in aggregate (excluding separate and distinct projects that have been fully completed and funding closed out). (This requirement does not apply to Cultural Projects.)