Courtesy of Comptroller Stringer’s Office

By Forum Staff

City Comptroller Scott Stringer this week proposed ways to help city tenants have their monthly rent payments count toward their credit scores, just like mortgage payments do for homeowners.

A new report and analysis by Stringer’s office shows “deep disparities” in credit scores across the five boroughs. “Giving Credit to Renters: How Reporting Rent Payments Can Lift NYC Credit Scores” used proprietary data to illustrate how “an alarming number” of residents have limited or no access to credit. Stringer said that is a challenge that can limit participation in the broader economy and put a ceiling on individuals’ financial success. According to the analysis, if rent were incorporated into credit histories, hundreds of thousands of Gotham residents who opted in would see their scores increase – and secure better, consumer-friendly rates for loans, car leases, and more.

“When millions of New Yorkers pay their rent on time, they should get credit for it, just like when homeowners pay their mortgage. Allowing New Yorkers’ rent history to boost their credit scores is a simple solution to a real, long-standing problem afflicting New Yorkers, and it’s another way to whittle away at our affordability crisis,” Stringer said. “If you’re low-income and don’t have credit, this is a commonsense solution that would help. With New York City becoming increasingly unaffordable, we have a chance to mitigate that massive challenge and make it easier for residents to get by. This is a smart approach that can help millions of New Yorkers raise their credit scores and as a result, pay less on their loans, car payments, and more. That’s why we’re planning to launch a working group with stakeholders from across New York to develop and implement strategies to give tenants a leg up.”

For the report, Stringer’s staff studied a representative sample of city tenants paying rents under $2,000 and found that reporting rent history would:

Raise credit scores for 76 percent of renters in the five boroughs who currently hold a credit score. Specifically: more than half (57 percent) would see their score rise between 1 and 10 points; nearly one in five (19 percent) would have their score boosted by 11 points or more; 18 percent would see no change at all; 6 percent would see a decline in their scores.

Provide nearly 30 percent of renters with a credit score for the first time. The average new score for these mostly low-income renters – now categorized as “invisible” or “unscorable” because of the relative dearth of financial information in their credit files – would be a prime score of 700.

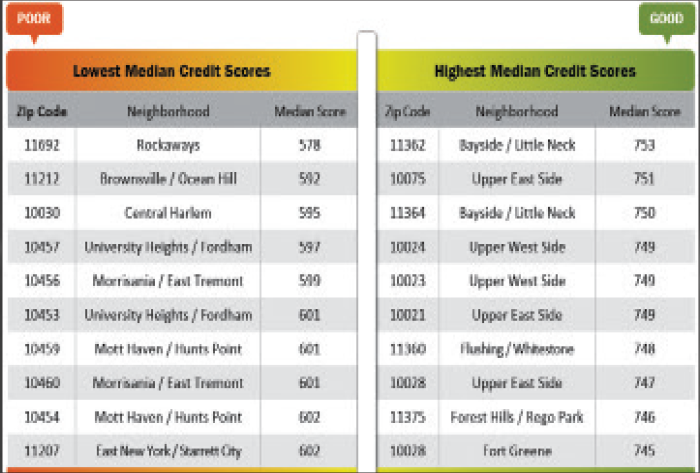

Additionally, the report includes a breakdown of those communities with the lowest and highest median credit scores in the Big Apple. In general, Stringer said, those communities with higher home ownership and car ownership rates – two key drivers of credit scores – boast higher average credit scores, among them Bayside/Little Neck in Queens, and the Upper East and Upper West Sides of Manhattan.

Stringer’s analysis also found “a real connection” in the city between low credit scores and factors like race, income level and home ownership rates.