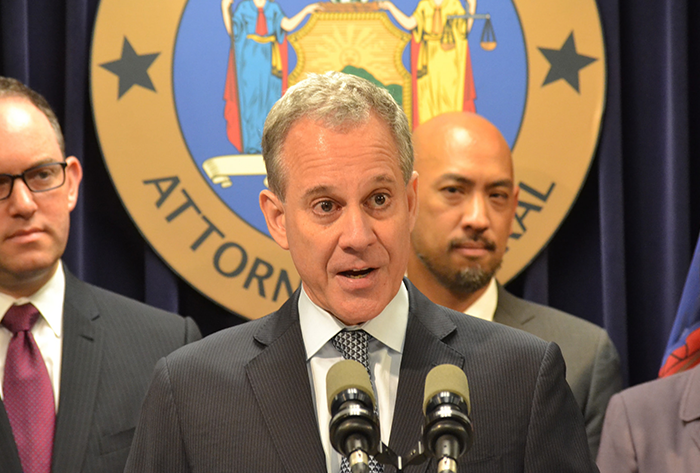

Photo Courtesy of NY Attorney General’s Office

The conviction and settlement “should send a clear message to those attempting to avoid paying their fair share: tax evasion is illegal, disgraceful — and it will not be tolerated,” AG Schneiderman said.

By Forum Staff

A John F. Kennedy International Airport food services company has pleaded guilty to felony charges stemming from an extensive scheme to avoid paying New York taxes between 2011 and 2015, State Attorney General Eric Schneiderman announced on Thursday.

Yankee Clipper Food Services I Corporation has copped to one count of first-degree grand larceny, one count of second-degree grand larceny, and one count of Scheme to Defraud in the first degree.

According to Schneiderman, following an investigation conducted by the AG’s Office, the company, along with several individuals and affiliated airport food service companies doing business under the trade name “Express Hospitality Group,” agreed to pay $13 million to settle separately filed civil claims initially raised by a whistleblower under the State’s False Claims Act.

Schneiderman noted that the plea and civil settlement are the first resolution in his ongoing probe – dubbed “Operation Greased Runway” – of the contracting and procurement process at JFK Airport.

According to Schneiderman, the investigation revealed that Express Hospitality Group engaged in schemes by which certain of its businesses intentionally underpaid over $5 million in taxes owed to New York and underpaid approximately $350,000 owed to the Port Authority of New York and New Jersey as part of a fee for operating at the airport. The investigation also uncovered that the company’s tax schemes involved maintaining a double set of books, collecting – but failing to remit – State and City sales tax, failing to withhold taxes on employee compensation, and underreporting receipts for corporate franchise tax purposes.

Additionally, while not the subject of the conviction and settlement announced today, the attorney general’s ongoing probe also revealed that Express Hospitality Group had a longstanding history of making secret cash payments to an airport executive with significant influence over Express Hospitality’s ability to conduct and expand its business at JFK Airport. In return for these monthly cash payments, the airport executive allegedly facilitated deals that granted certain Express Hospitality businesses favorable treatment, offered new business opportunities to the company, and provided security passes to certain employees of Express Hospitality outside the normal process for obtaining airport security passes.

“For years, Express Hospitality Group disregarded state law and New York taxpayers,” Schneiderman said. “Today’s felony conviction and settlement should send a clear message to those attempting to avoid paying their fair share: tax evasion is illegal, disgraceful — and it will not be tolerated.”

The AG’s Office and the Office of the Inspector General of the Port Authority investigated the claims of a whistleblower with credible information about Express Hospitality Group’s illegal business practices.

“Today’s announcement exposes an insidious pattern of corruption that allowed the defendants to freely and fraudulently siphon millions of dollars and defraud taxing authorities and the Port Authority of New York and New Jersey,” said Port Authority Inspector General Michael Nestor. “My office will continue to work vigorously with the New York State Attorney General’s Office and its law enforcement partners to identify, investigate and prosecute such fraud.”