By Forum Staff

Over the last decade, property tax rates have increased at triple the rate of incomes, making it nearly twice as hard to pay for these taxes for city households with incomes less than $100,000, according to a report released on Thursday by City Comptroller Scott Stringer.

Stringer’s analysis, “Growing Unfairness: The Rising Burden of Property Taxes on Low-Income Households,” details the disparity in how property tax burdens have grown for working families, and highlights what Stringer characterized as “the ineffectiveness of current property tax relief programs, which are narrowly funded, highly restrictive, and fail to support struggling New York City homeowners.”

The report spotlights the significant impact that property tax increases have had on households making less than $250,000, particularly for homeowners earning less than $100,000 per year who make up roughly half of all city property tax filers and experience the most significant burdens. Specifically:

• Households making less than $50,000 saw their property taxes increase by 98 percent and their median incomes drop by almost 1 percent since 2005. As a result, the property tax burden for these New Yorkers nearly doubled to almost 13 percent in 2016 from 6.6 percent of income in 2005;

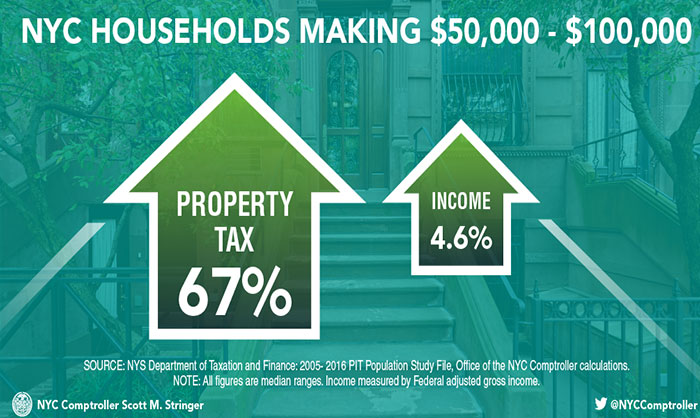

• Households making between $50,000 and $100,000 saw their property taxes increase by 67 percent since 2005 as their median income grew by 4.6 percent. As a result, their burden grew to 5.4 percent in 2016 from 3.4 percent of income in 2005; and

• Households making between $100,000 and $250,000 saw their property taxes increase by 54 percent as median income rose by 4.9 percent. As a result, their burden grew to 3.7 percent in 2016 from 2.4 percent of income in 2005.

And Stringer said the property tax relief programs don’t provide much, well, relief: the School Tax Relief (STAR) Property Exemption and the NYC Enhanced Property Tax Benefit offer $300 and $52, respectively, providing little relief against the average cost of property tax bills of nearly $4,000 for households making less than $100,000 a year; more generous programs, such as the Enhanced STAR exemption, are generally restricted to low-income senior citizens; and other localities offer more generous benefits for lower income households and provide a model for reform. For example, a household making $33,000 and paying property taxes of $3,800 would receive a property tax benefit nearly 20 times as generous in Maryland than in New York, the comptroller said.

In order to ease the burden on low and middle income families, Stringer recommended that the newly established property tax commission consider expanding tax credit eligibility and making benefits more generous to combat the increasingly regressive burden of property taxes.

“Property taxes are rising too fast and incomes are rising too slowly – and it’s becoming harder than ever for already struggling New Yorkers to get ahead,” Stringer added. “Rising property taxes are becoming a barrier to the middle class and we can’t afford to continue down this path. We need to give New Yorkers a break, and turn a regressive tax system into a fair and progressive one. We must explore common-sense solutions and expand tax relief to level the playing field for working families.”

Courtesy of the Office of the City Comptroller