By Michael V. Cusenza

The City Department of Housing Preservation and Development recently announced a brand-new program aiming to build affordable and mixed-income homes across the five boroughs: the Mixed Income Market Initiative.

The program was created to tackle the decades-long housing and homelessness crisis at a time when State and federal resources are increasingly scarce. Understanding the urgency of the crisis, Adams said the City is pioneering new ways to build new homes for working families, older adults, children, and all New Yorkers who struggle because there are simply too few homes and nearly no affordable apartments available. Using “innovative financing solutions” and City capital, MIMI aims to support the construction of new homes across the city.

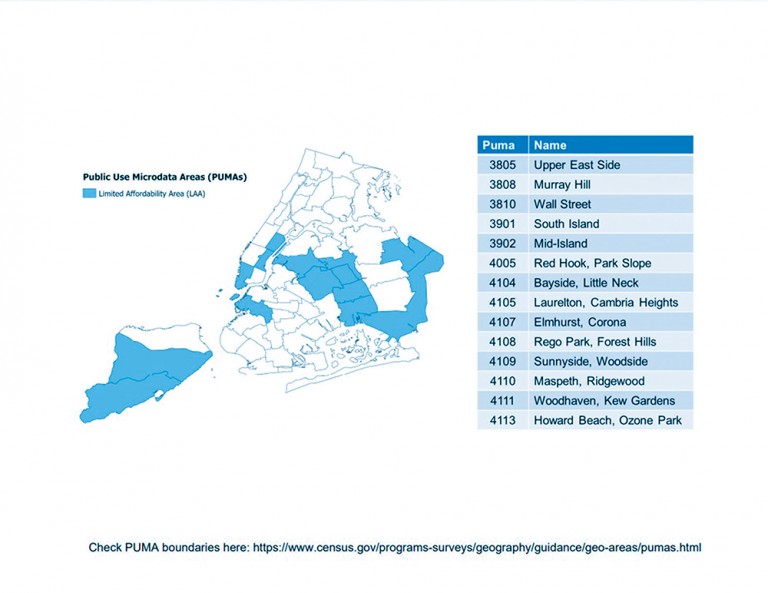

MIMI facilitates new construction of mixed-income, multi-family rental projects in areas without many low-cost housing options. More specifically, the new initiative provides city subsidies to projects that include homes for a wide range of household incomes – from extremely-low income and homeless set-aside units, to moderate-income and even market rate units.

By including market rate units, this new financing model leverages market rate rental units to help finance affordable housing development while increasing housing choice and household mobility in parts of the city where there are fewer low-cost homes available, HPD noted. Additionally, the program aims to more efficiently use cite resources by leveraging higher revenue from market rate units, thus expanding the city’s affordable housing tools while preserving Federal Low Income Housing Tax Credits and other scarce resources for use on other affordable housing projects.

The administration said that the MIMI program aims to use public resources more effectively by combining city subsidy and Article XI property tax exemptions with private financing sources and revenue from market rate units. This mix of financing sources does not rely on other sources of public funding, like the city’s short supply of Federal Low Income Housing Tax Credits. Using city subsidy alongside private financing in mixed-income projects with market rate units enables the city to build affordable housing faster while using LIHTC more strategically to achieve the city’s affordable and fair housing goals.

Adams said housing developers may apply to participate in the initiative through a Request for Expression of Interest on the HPD website. Projects selected to move forward must be 70 percent affordable and 30 percent market rate.

Proposals may include a wide range of housing options, including homeless-set aside units, supportive housing units, and a mix of income-restricted units at rents between 0 percent to 120 percent of the area median income, in addition to the market rate units. One in four of the rent-restricted units must be for extremely low- or very low-income households, inclusive of a 15 percent set-aside for formerly homeless New Yorkers, and applicants may propose deeper affordability

Preference will be given to proposals with the deepest affordability levels that also efficiently use public resources. The program assumes funding sources for selected projects including discretionary property tax exemptions approved by the City Council in addition to city capital. Using these sources, amongst others, HPD is aiming to maximize affordability and the efficient use of resources, none of which will be used to subsidize the market rate units.

Councilman Bob Holden (D-Maspeth) is not a fan of the plan.

“This ‘affordable’ housing program is simply a major giveaway to developers at the cost of our neighborhoods. It won’t be affordable and will only lead to more empty skyscrapers like those along our waterfronts,” Holden said. “The City should be focused on fixing our infrastructure.”